Cheque Clearing and Processing

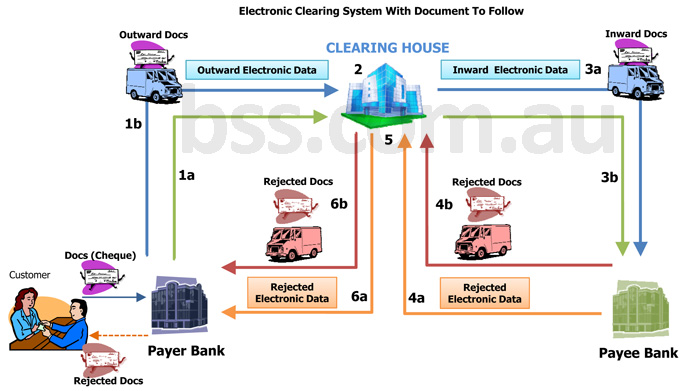

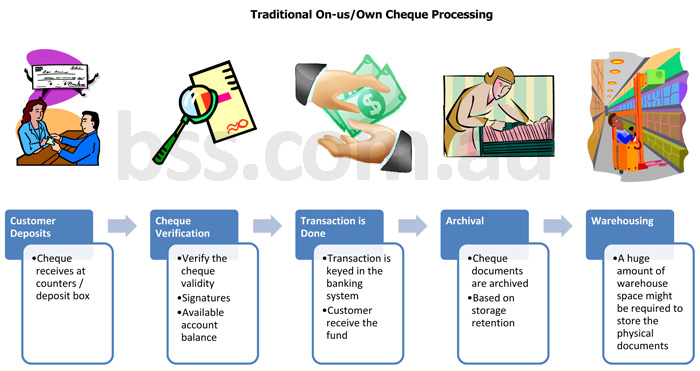

Cheque clearing is basically a process in which interbank cheques are processed for settlement. Cheque clearing is usually done by an authorised clearing house or, in some countries, by the central bank.

Electronic cheque clearing allows for faster settlement, up to one day settlement in some countries. In other countries, however, cheque settlement may take longer due to more intricate procedures such as upstream to downstream processing of physical documents, in this case the paper cheque.

Regardless of the different procedures and settlement time, at the end cheque clearing and settlement processes facilitate financial transactions between participating institutions, especially banks.

There are several mechanisms with which cheque clearing / cheque settlement may be conducted in a country. Some countries may adopt a particular cheque clearing mechanism, while other countries may have preferred a different business flow. Nevertheless, here are cheque clearing and settlement procedures you may find:

- How can each clearing institution obtain accurate proof of transaction without exchange of document to follow?

- What will payee bank refer to in case of dispute in future?

- More importantly, is there a way to minimise reliance on third party for processing and generation of electronic data for high security documents such as interbank cheques

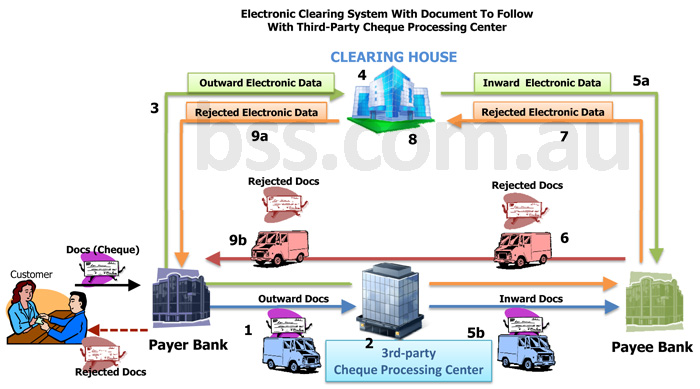

In order to eliminate the hassles of dealing with thousands to millions of paper cheques and converting transaction data to the prescribed format of data exchange, financial institutions in some countries have outsourcedthe processing of both physical cheque (document to follow) and conversion of electronic data to third-party cheque processing centre (CPC).

Benefits of implementing this system

With this mechanism, both payer bank and clearing house are spared from having to invest on bulky cheque processing equipment, nor do they need to spare extra resources to supervise reading and sorting of mounts of documents or perform laborious data entry. All they have to deal with is transfer and settlement of electronic data, which is usually done semi-automatically with computerised application and minimum user intervention.

At the end of the day, payee bank will still receive the original cheques as document to follow and, therefore, isstill able to verify the electronic data against those documents sent from CPC. Approved cheques will be archived internally, while rejected cheques will be sent back to payerbank via CPC. The payer bank will in turn receive both the rejected paper cheques and corresponding rejects of electronic data from CPC and clearing house.

Questions to ponder

Implementation of such clearing system has presented several issues which, among others, include:

- How can clearing institutions exchange highly sensitive transaction data effectively?

- How to minimise investment on cheque processing and exchange of physical cheque considering the decline of cheque usage worldwide?

- More importantly, is there a way to reduce reliance on third party for processing and exchange of high security documents such as interbank cheques?

- How can each clearing institution obtain accurate proof of transaction without exchange of document to follow?

- What will payee bank refer to in case of dispute in future?

- More importantly, is there a way to minimise reliance on third party for processing and generation of electronic data for high security documents such as interbank cheques

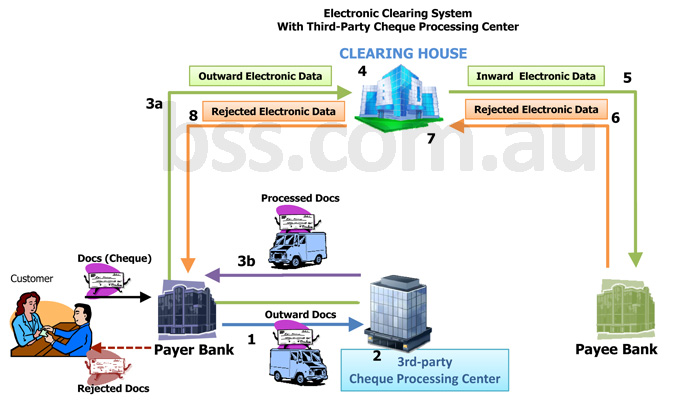

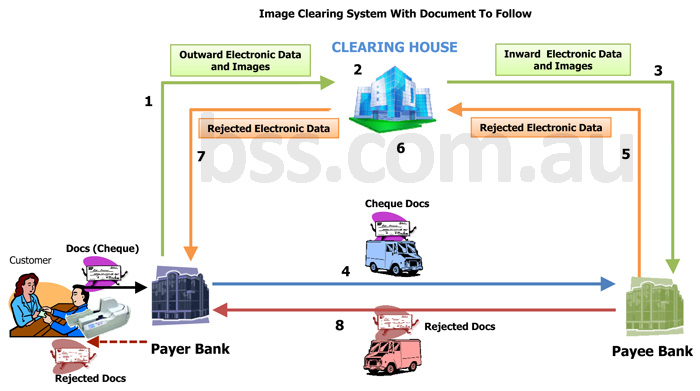

To provide proof of transaction for each clearing institution including the clearing house, yet minimise transportation of paper cheques across multiple institutions, payer banks in some countries have adopted digital solution that scan physical cheques they receive and send the images along with electronic data to clearing house and subsequently to payee bank. Upon processing and delivery of outward cheque data and images, original cheque is usually couriered directly to payee bank as document to follow, without stopping over at clearing house.

Benefits of implementing this system

This system provides double benefits of provision of proof of transaction to every clearing institution, in the form of digital copies of cheques, as well as corresponding document to follow to payee bank for dual control in verification and authentication of transaction. In addition, the reduced number of parties involved in handling original cheques would definitely save a significant amount of time required in settlements of interbank transactions.

Questions to ponder

The issue is, nevertheless, there is still cost and investment involved for sorting, transportation and storage of paper cheques. The question is:

- How do institutions completely eliminate the risk and investment involved in processing, transporting and storage of physical cheques?

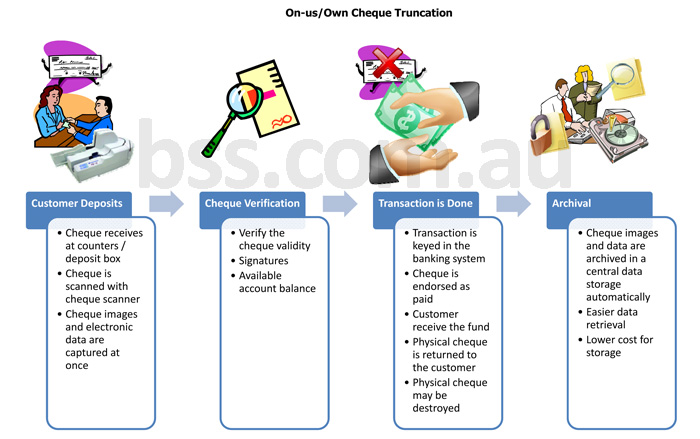

One way to address the issue on archival of physical on-us cheques is by implementing cheque truncation. Upon deposit of cheque over the counter or in cheque deposit box, teller or back office staff can scan cheque images while capturing transaction data at the same time. Processing of cheque can immediately be performed using solely the electronic data and cheque images. In other words, original cheques – no longer required in the process – can be returned to customers or payees after being endorsed. Alternatively, paper cheques can also be destroyed upon payment of cheque fund.

Benefits of implementing this system

In short, since storage of paper cheques is no longer required, banks do not need to make investment for special storage facility nor for transport and handling of cheque archives. Electronic cheque data and their images can be stored in digital storage space such as computer server, which implies low cost storage and much less physical space. In addition, with computerised archival of both cheque data and images, system archival is guaranteed and data retrieval can be relatively easy. Electronic archive of cheques can even be stored centrally in the head office and be made accessible from all bank branches.

Last but not least, by digitalising proof of transaction computerised integration with verification system such as signature verification system becomes highly feasible.

Questions to ponder

The questions are, however:

- Is there a solution that delivers such optimum archival and verification benefits available in the market?

- Which solution is most effective both function-wise and cost-wise?

- How to minimise the risk of wear and tear of cheque archives, especially considering multiple handling done manually and long-term storage of paper cheque?

- How to eliminate the need and cost of transporting cheque to special storage facility and, better still, cut down investment on such facility?

- Is there a solution that is reliable and responsive enough to make verification of cheques and customers’ data especially signatures become practical and least time-consuming?

- More importantly, how to create an archive library that is systematic enough such that retrieval of cheque archive becomes significantly practical and cost effective, especially for banks with multiple branches?

- What is the best, most effective cheque truncation solution available in the market?

- How simple can cheque truncation and data entry process be with this solution?

- How competent is the solution provider in handling high security data processing and management?

- Is the solution provider highly experienced in inter-institution and nationwide projects?

- More importantly, how quickly adaptable is the solution and the solution provider in response to the ever-changing trend in cheque processing and settlement?